Home /

Expert Answers /

Accounting /

revenue-is-recognized-when-it-is-earned-and-expenses-when-they-are-incurred-regardless-of-when-cash-pa348

(Solved): Revenue is recognized when it is earned, and expenses when they are incurred regardless of when cash ...

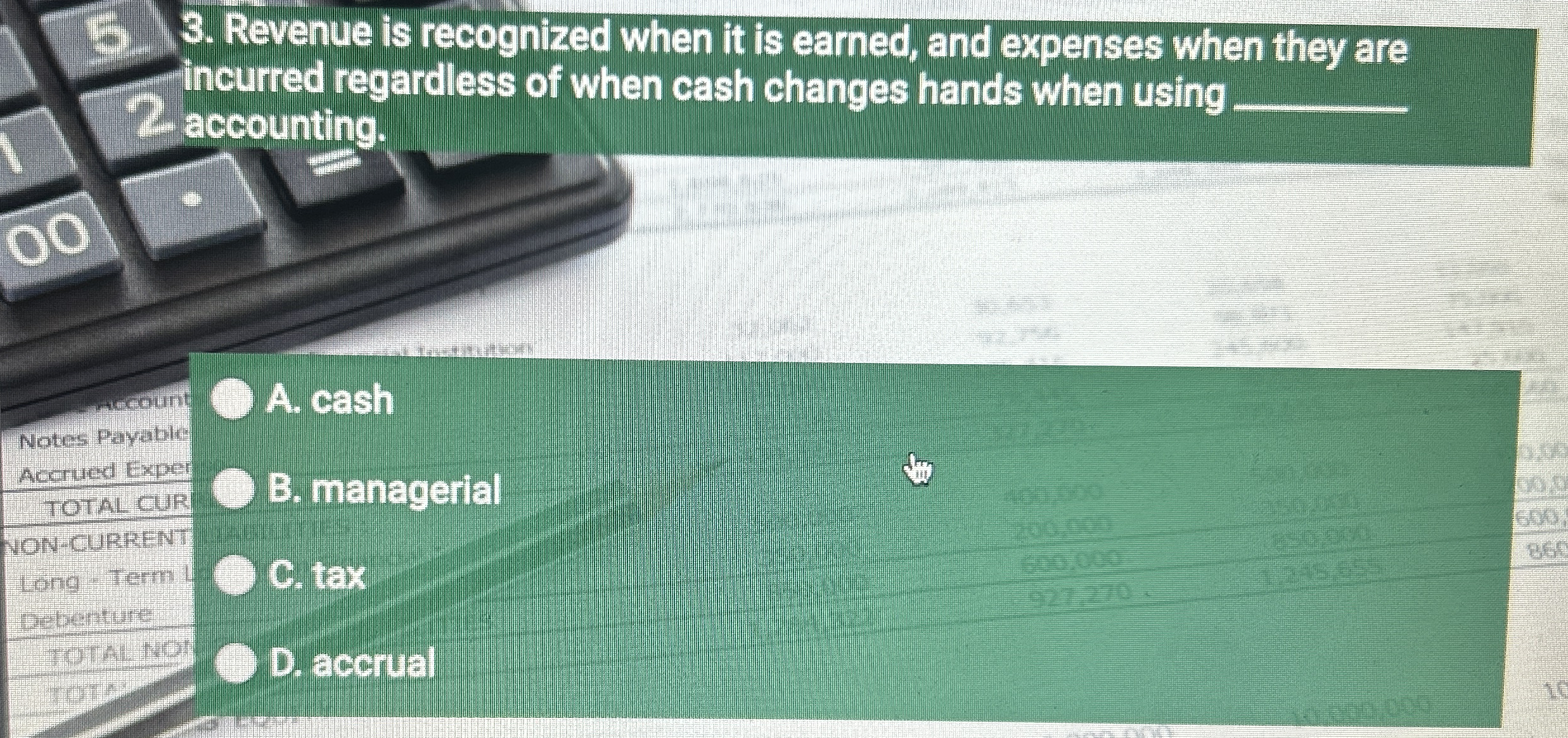

Revenue is recognized when it is earned, and expenses when they are incurred regardless of when cash changes hands when using

q,accounting. A. cash Notes Payable Accrued Exper TOTAL CUR B. managerial NON-CURRENT Long Term C. tax Debenture TOTAL NOI D. accrual