Home /

Expert Answers /

Accounting /

sally-needs-to-make-several-changes-to-her-2022-return-she-plans-to-amend-the-return-immediately-a-pa580

(Solved): Sally needs to make several changes to her 2022 return. She plans to amend the return immediately. A ...

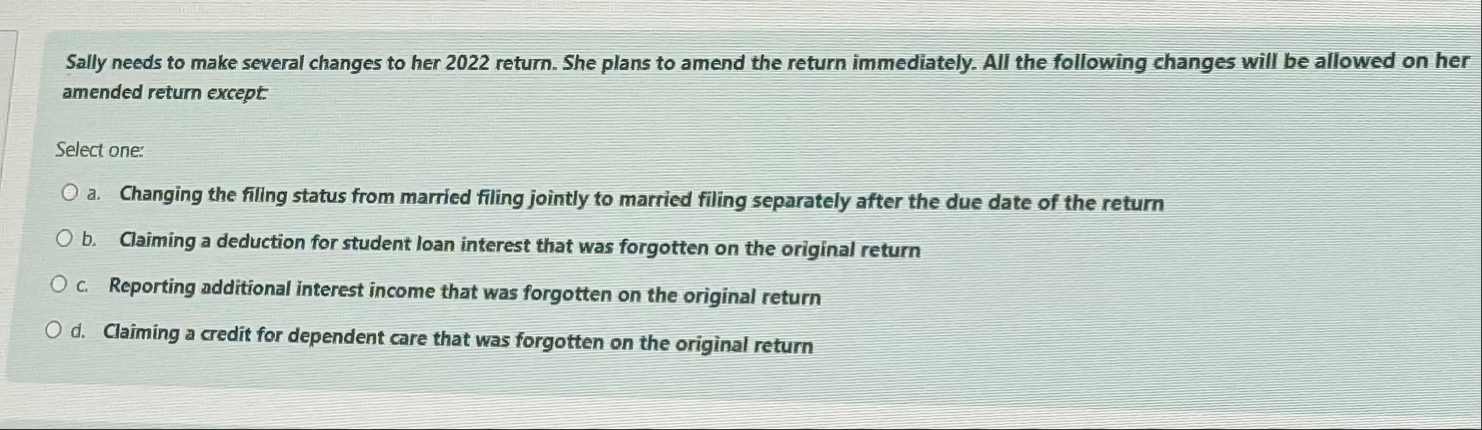

Sally needs to make several changes to her 2022 return. She plans to amend the return immediately. All the following changes will be allowed on her amended return except: Select one: a. Changing the filling status from married filing jointly to married filing separately after the due date of the return b. Claiming a deduction for student loan interest that was forgotten on the original return c. Reporting additional interest income that was forgotten on the original return d. Claiming a credit for dependent care that was forgotten on the original return