Home /

Expert Answers /

Economics /

section-busing-the-following-figure-determine-the-net-impact-on-homes-welfare-when-it-imposes-a-pa725

(Solved): Section BUsing the following figure, determine the net impact on Homes welfare when it imposes a ...

Section B

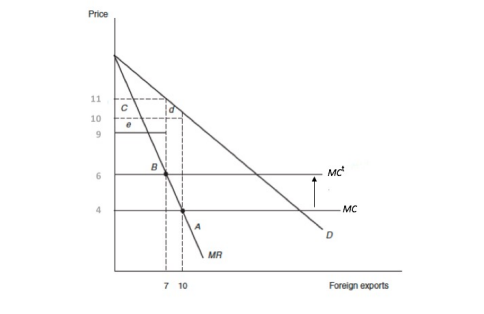

Using the following figure, determine the net impact on Home’s welfare when it imposes a tariff of $2 on the Foreign monopolist.

This was all the information provided to answer the question.

Expert Answer

When Home imposes a tariff on the Foreign monopolist, it effectively increases the price of imported goods in Home. The specific impact on Home's welfare will depend on various factors such as the elasticity of demand and supply, the size of the tariff, and market conditions.In general, the imposition of a tariff can have both positive and negative effects on Home's welfare:Positive effects : The tariff may lead to an increase in domestic production and employment as it makes imported goods relatively more expensive. This can benefit domestic producers and workers in the industry affected by the tariff. Additionally, the tariff can generate government revenue if it is collected as a tax.Negative effects: The tariff can result in higher prices for consumers in Home, reducing their purchasing power and potentially lowering consumer welfare. It may also lead to a reduction in consumer choice if imported goods become less affordable or unavailable due to the higher prices.