Home /

Expert Answers /

Economics /

suppose-the-price-elasticity-of-demand-is-mathbf-1-2-and-the-price-elasticity-of-supply-pa538

(Solved): Suppose the price elasticity of demand is \( \mathbf{- 1 . 2} \) and the price elasticity of supply ...

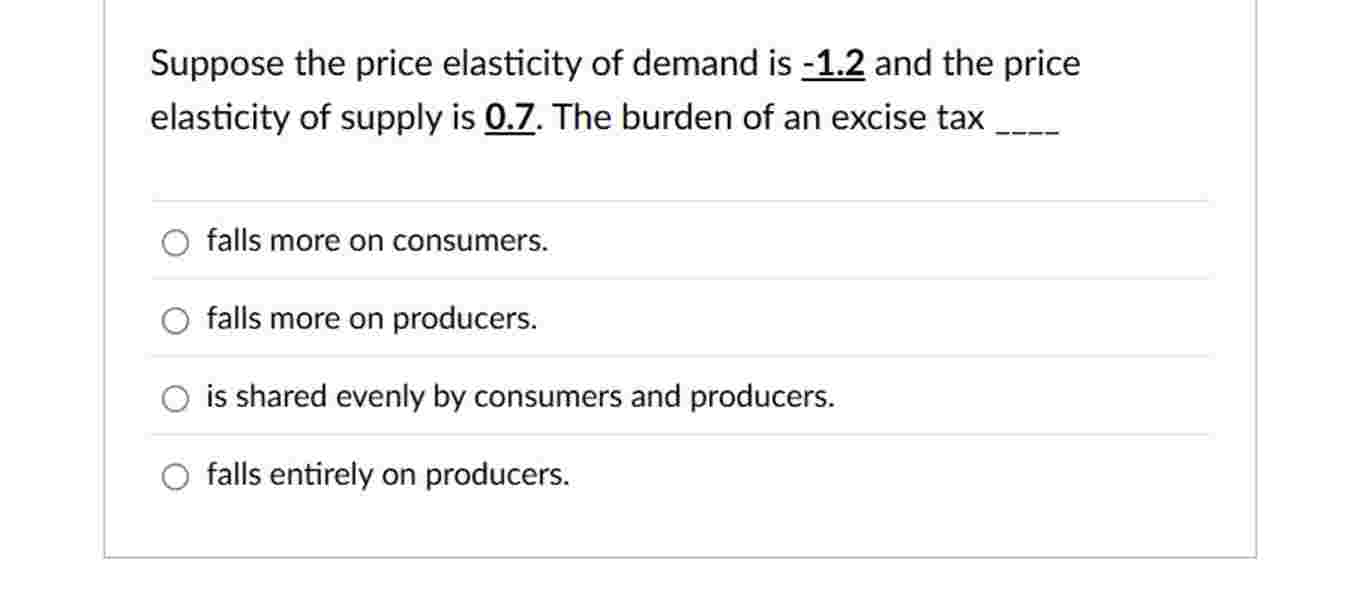

Suppose the price elasticity of demand is \( \mathbf{- 1 . 2} \) and the price elasticity of supply is \( \underline{0.7} \). The burden of an excise tax falls more on consumers. falls more on producers. is shared evenly by consumers and producers. falls entirely on producers.