Home /

Expert Answers /

Finance /

suppose-you-plan-to-retire-30-years-from-now-you-plan-to-live-25-years-after-you-retire-you-will-n-pa448

(Solved): Suppose you plan to retire 30 years from now. You plan to live 25 years after you retire. You will n ...

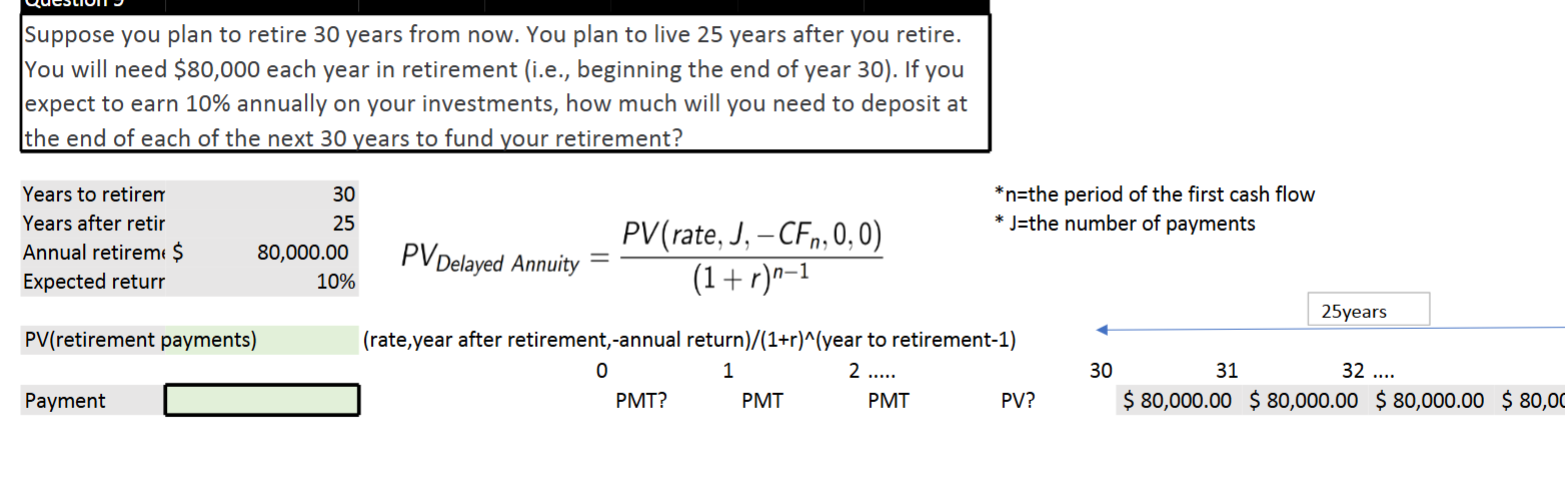

Suppose you plan to retire 30 years from now. You plan to live 25 years after you retire. You will need $80,000 each year in retirement (i.e., beginning the end of year 30). If you expect to earn 10% annually on your investments, how much will you need to deposit at the end of each of the next 30 years to fund your retirement? Suppose you plan to retire 30 years from now. You plan to live 25 years after you retire. You will need \( \$ 80,000 \) each year in retirement (i.e., beginning the end of year 30 ). If you expect to earn \( 10 \% \) annually on your investments, how much will you need to deposit at the end of each of the next 30 years to fund your retirement?