Home /

Expert Answers /

Finance /

the-cfo-of-adt-machines-is-considering-a-new-project-with-the-following-cash-flows-in-millions-pa967

(Solved): The CFO of ADT Machines is considering a new project with the following cash flows [in $ millions]: ...

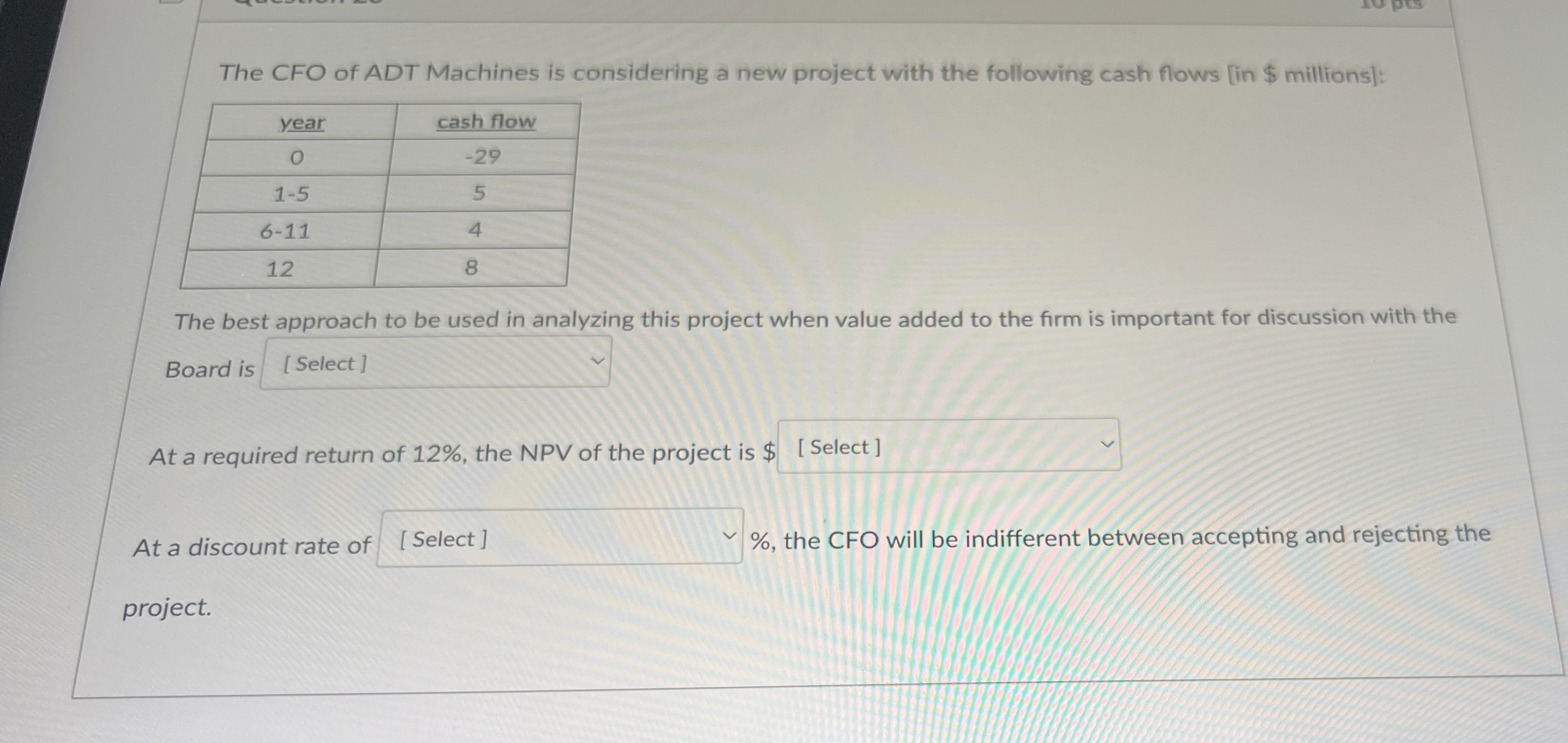

The CFO of ADT Machines is considering a new project with the following cash flows [in

$millions]: \table[[year,cash flow],[0,-29],[

1-5,5],[

6-11,4],[12,8]] The best approach to be used in analyzing this project when value added to the firm is important for discussion with the Board is

◻At a required return of

12%, the NPV of the project is

$

◻At a discount rate of

◻

%, the CFO will be indifferent between accepting and rejecting the project.