Home /

Expert Answers /

Accounting /

the-directors-of-dundee-ltd-a-textile-manufactirer-are-deciding-whether-to-purchase-some-new-equi-pa772

(Solved): The directors of Dundee Ltd, a textile manufactirer, are deciding whether to purchase some new equi ...

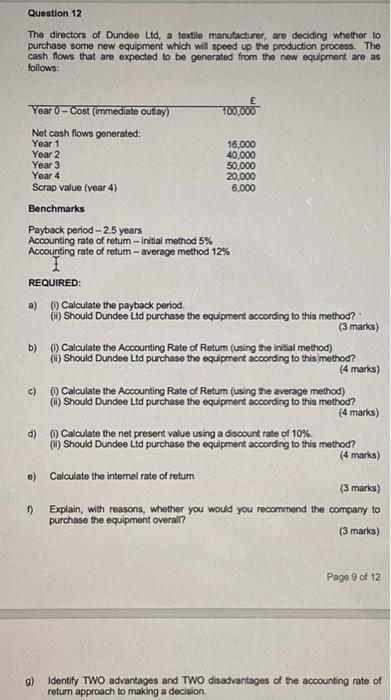

The directors of Dundee Ltd, a textile manufactirer, are deciding whether to purchase some new equipment which will speed up the production process. The cash flows that are expected to be generated from the new equipment are as follows: Benchmarks Payback period \( -2.5 \) years Accounting rate of retum - initial method \( 5 \% \) Accounting rate of retum - average method \( 12 \% \) REQUIRED: a) (i) Calculate the payback period. (ii) Should Dundee Ltd purchase the equipment according to this method? (3 marks) b) (1) Calculate the Accounting Rate of Retum (using the initial method) (ii) Should Dundee Lid purchase the equipment according to this method? (4 marks) c) (i) Calculate the Accounting Rate of Retum (using the average method) (ii) Should Dundee Lid purchase the equipment according to this method? (4 marks) d) (i) Calculate the net present value using a discount rate of \( 10 \% \). (ii) Should Dundee Ltd purchase the equipment acoording to this method? (4 marks) e) Calculate the internel rate of return (3 marks) f) Explain, with reasons, whether you would you recommend the company to purchase the equipment overali? (3) marks) Page 9 of 12 g) Identify TWO advantages and TWO disadvantages of the accounting rate of retum approach to making a decision.

Expert Answer

Solution: a) i) Pauback period. = 2 + 44000/50000 = 2 + 0.88 = 2.88 years. Ii) Since payback period as per the benchmark is 2.5 years so Dundee Ltd should not purchase the equipment as per this method. b) i) Accounting rate of return usi