(Solved): The following are partially completed T-accounts for Metlock. The accountant needs help filling in t ...

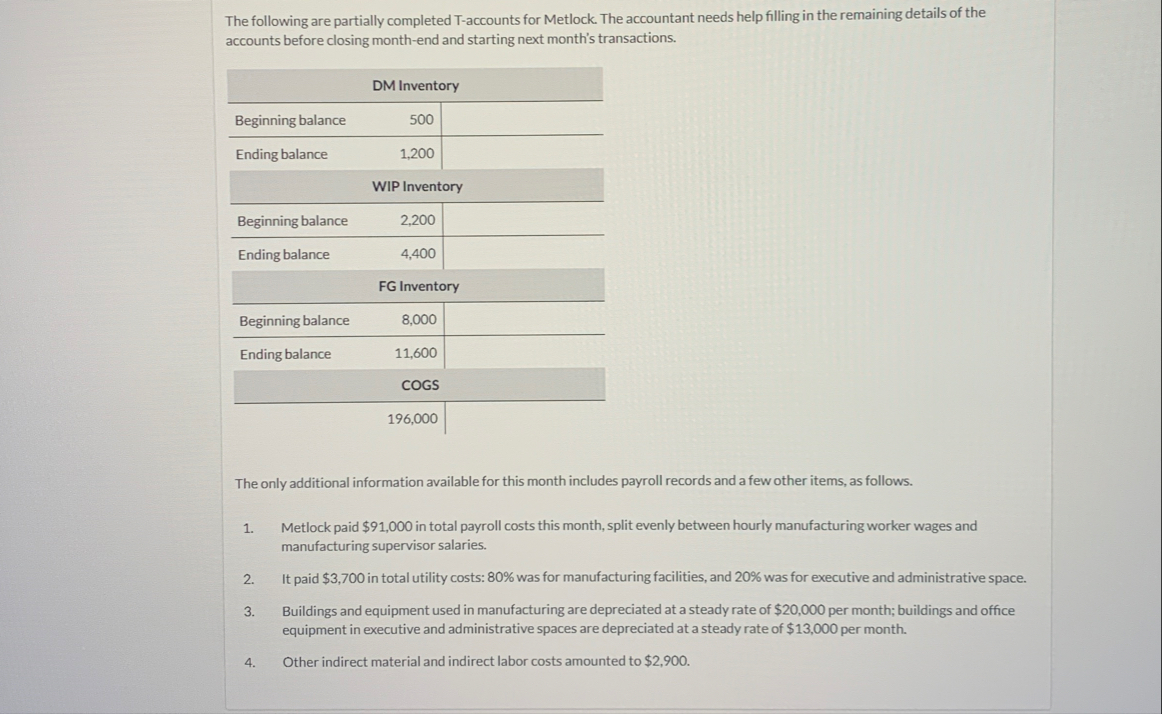

The following are partially completed

T-accounts for Metlock. The accountant needs help filling in the remaining details of the accounts before closing month-end and starting next month's transactions. The only additional information available for this month includes payroll records and a few other items, as follows. Metlock paid

$91,000in total payroll costs this month, split evenly between hourly manufacturing worker wages and manufacturing supervisor salaries. It paid

$3,700in total utility costs:

80%was for manufacturing facilities, and

20%was for executive and administrative space. Buildings and equipment used in manufacturing are depreciated at a steady rate of

$20,000per month; buildings and office equipment in executive and administrative spaces are depreciated at a steady rate of

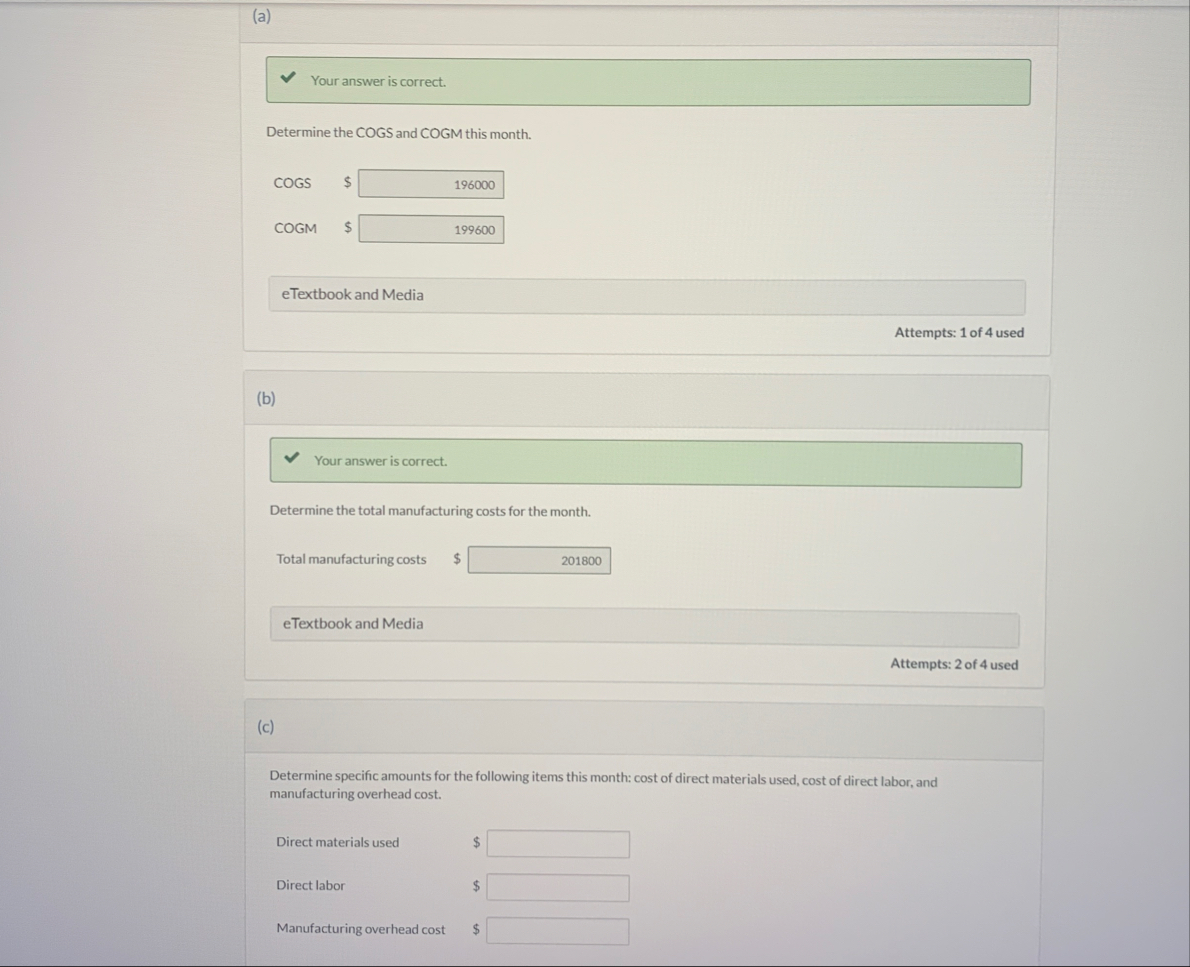

$13,000per month. Other indirect material and indirect labor costs amounted to $2,900.(a) Your answer is correct. Determine the COGS and COGM this month. COGS $

◻COGM $

◻eTextbook and Media Attempts: 1 of 4 used (b) V Your answer is correct. Determine the total manufacturing costs for the month. Total manufacturing costs $

◻eTextbook and Media Attempts: 2 of 4 used (c) Determine specific amounts for the following items this month: cost of direct materials used, cost of direct labor, and manufacturing overhead cost. Direct materials used Direct labor $

◻Manufacturing overhead cost $

◻