Home /

Expert Answers /

Accounting /

the-following-reflects-the-forecasts-of-kabook-limited-for-the-year-2025-for-the-only-product-that-i-pa955

(Solved): The following reflects the forecasts of Kabook Limited for the year 2025 for the only product that i ...

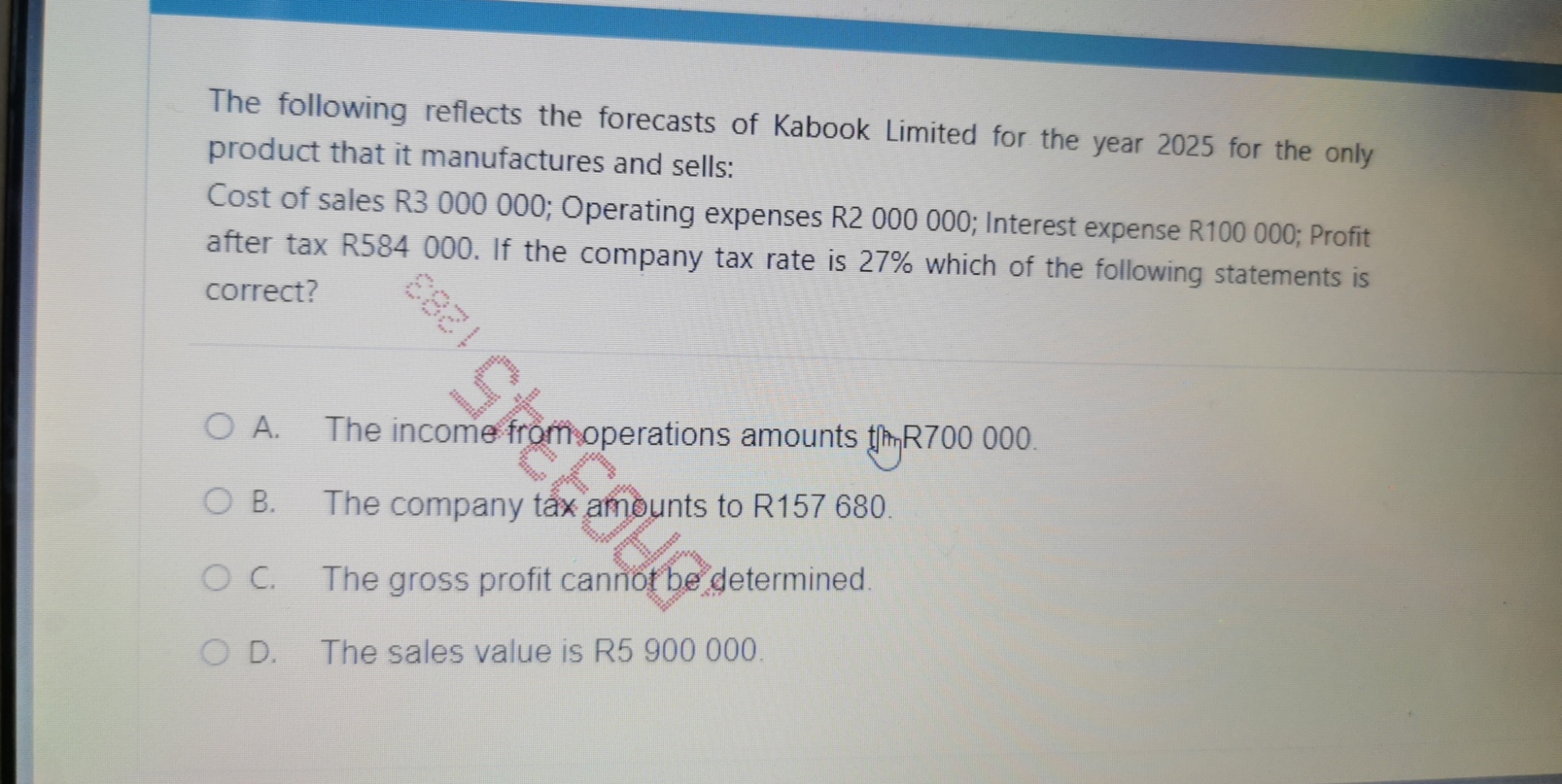

The following reflects the forecasts of Kabook Limited for the year 2025 for the only product that it manufactures and sells: Cost of sales R3 000 000; Operating expenses R2 000000 ; Interest expense R100 000; Profit after tax R584000. If the company tax rate is

27%which of the following statements is correct? A. The income from soperations amounts thR

R700000B. The company tax amounts to R157680. C. The gross profit cannor be determined D. The sales value is R5 900000 .