Home /

Expert Answers /

Finance /

the-interest-paid-on-muni-bonds-is-not-subject-to-federal-income-tax-municipal-bonds-are-less-des-pa901

(Solved): The interest paid on muni bonds is not subject to federal income tax. Municipal bonds are less des ...

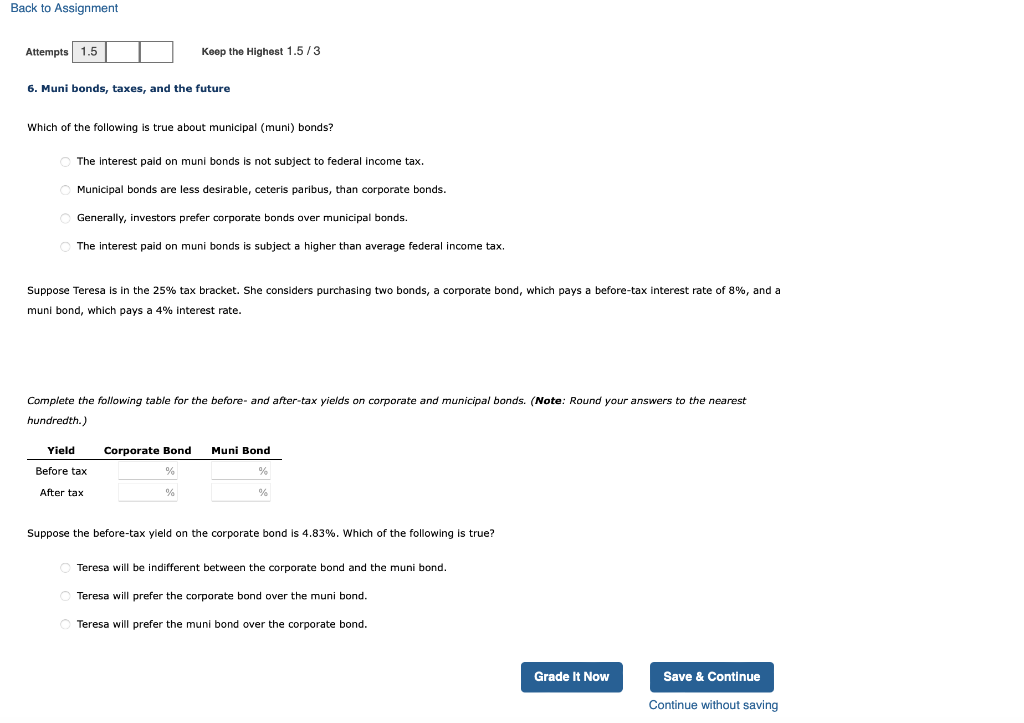

The interest paid on muni bonds is not subject to federal income tax. Municipal bonds are less desirable, ceteris paribus, than corporate bonds. Generally, investors prefer corporate bonds over municipal bonds. The interest paid on muni bonds is subject a higher than average federal income tax. Suppose Teresa is in the tax bracket. She considers purchasing two bonds, a corporate bond, which pays a before-tax interest rate of , and a muni bond, which pays a interest rate. Complete the following table for the before- and after-tax yields on corporate and municipal bonds. (Note: Round your answers to the nearest hundredth.) Suppose the before-tax yleld on the corporate bond is . Which of the following is true? Teresa will be indifferent between the corporate bond and the muni bond. Teresa will prefer the corporate bond over the muni bond. Teresa will prefer the muni bond over the corporate bond.

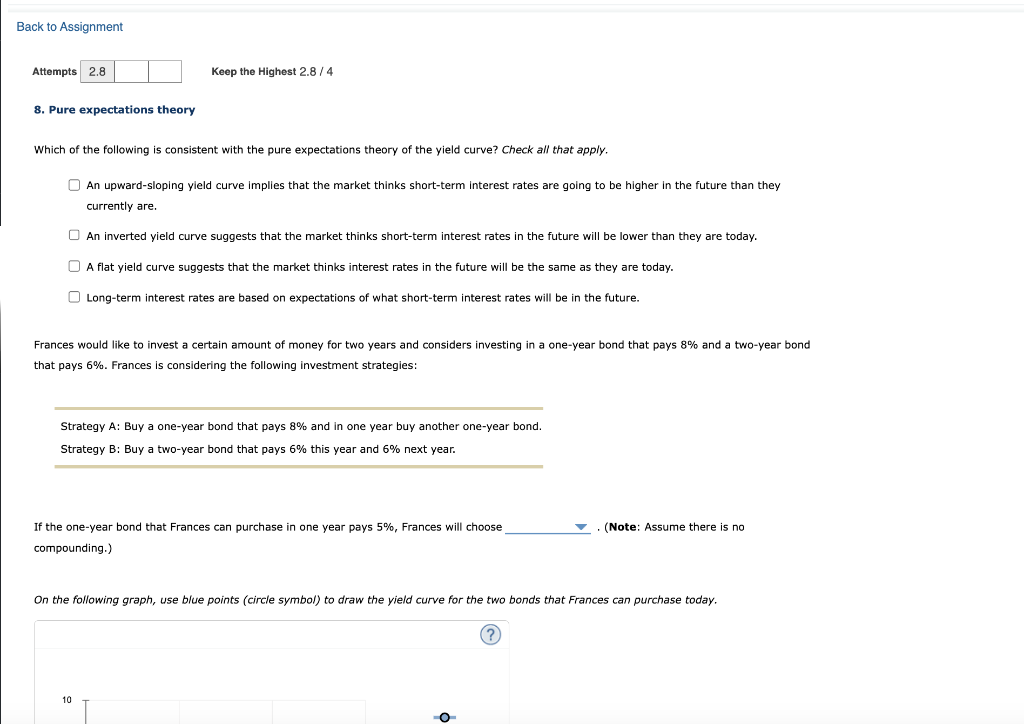

An upward-sloping yield curve implies that the market thinks short-term interest rates are going to be higher in the future than they currently are. An inverted yield curve suggests that the market thinks short-term interest rates in the future will be lower than they are today. A flat yield curve suggests that the market thinks interest rates in the future will be the same as they are today. Long-term interest rates are based on expectations of what short-term interest rates will be in the future. Frances would like to invest a certain amount of money for two years and considers investing in a one-year bond that pays and a two-year bond that pays . Frances is considering the following investment strategies: Strategy A: Buy a one-year bond that pays and in one year buy another one-year bond. Strategy B: Buy a two-year bond that pays this year and next year. If the one-year bond that Frances can purchase in one year pays , Frances will choose . (Note: Assume there is no compounding.)

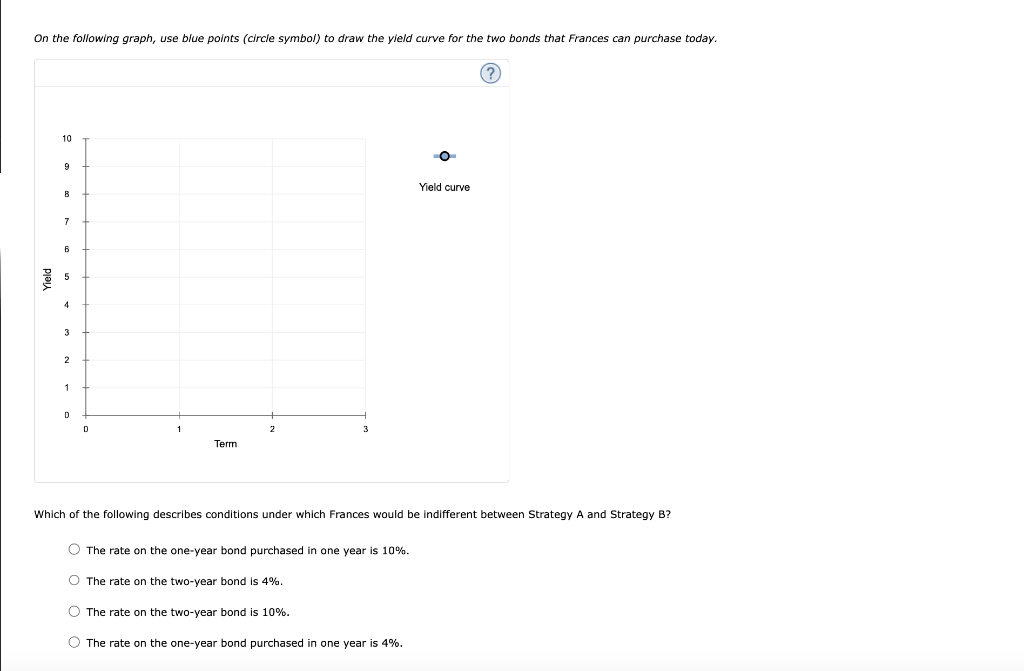

On the following graph, use blue points (circle symbol) to draw the yield curve for the two bonds that Frances can purchase today. Which of the following describes conditions under which Frances would be indifferent between Strategy A and Strategy B? The rate on the one-year bond purchased in one year is . The rate on the two-year bond is . The rate on the two-year bond is . The rate on the one-year bond purchased in one year is .