(Solved): The Suboptimal Glass Company uses a process of capital rationing in its decision making. The firm's ...

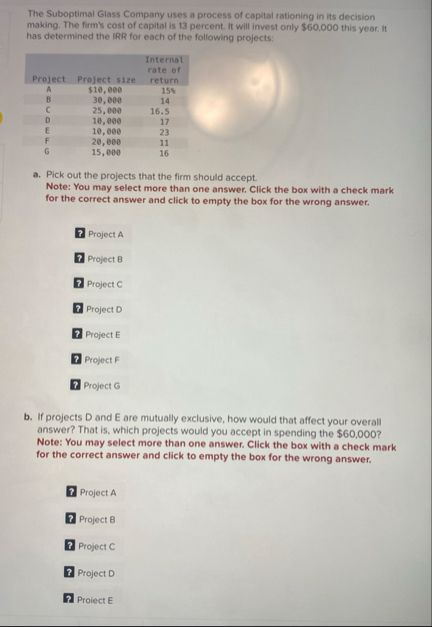

The Suboptimal Glass Company uses a process of capital rationing in its decision making. The firm's cost of capital is 13 percent. It will invest only

$60.000this year. it has determined the IRR for each of the following projects: \table[[Project Project size,\table[[Internal],[rate of],[return]],],[A,

$10,000,154],[B,30,000,14],[C,25,000,16.5],[D,10,000,17],[E,10,000,23],[F,20,000,11],[G,15,000,16]] a. Pick out the projects that the firm should accept. Note: You may select more than one answer. Click the box with a check mark for the correct answer and click to empty the box for the wrong answer. 1 Project A

?Project B 1 Project C 3 Project D 1 Project E 7 Project F 1 Project G b. If projects D and E are mutually exclusive, how would that affect your overall answer? That is, which projects would you accept in spending the

$60,000? Note: You may select more than one answer. Click the box with a check mark for the correct answer and click to empty the box for the wrong answer. Project A 1 Project B 2 Project C 3 Project D 12 Proiect E