Home /

Expert Answers /

Accounting /

the-willa-estate-reports-100-000-dni-composed-of-50-000-dividends-20-000-taxable-interest-pa745

(Solved): The Willa estate reports $100,000 DNI, composed of $50,000 dividends, $20,000 taxable interest, $ ...

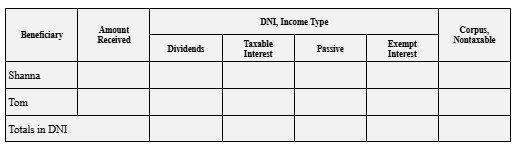

The Willa estate reports $100,000 DNI, composed of $50,000 dividends, $20,000 taxable interest, $10,000 passive income, $20,000 tax-exempt interest. Willa’s two noncharitable income beneficiaries, Shanna and Tom, receive distributions of $75,000 each. How much of each class of income is deemed to have been distributed to Shanna? To Tom? Use the following template to structure your answer. (CHART - see attached picture) Beneficiary | Amount Received Shanna Tom DNI, Income Type (for each Shanna and Tom) Dividends Taxable Interest Passive Exempt Interest Corpus, Nontaxable Totals in DNI for each (Dividends, Taxable Interest, PAssive, Exempt Interest, Corpus Nontaxable)