Home /

Expert Answers /

Accounting /

turner-company-purchased-35-of-the-outstanding-stock-of-ica-company-for-11-800-000-on-january-2-2-pa183

(Solved): Turner Company purchased 35% of the outstanding stock of ICA Company for $11,800,000 on January 2,2 ...

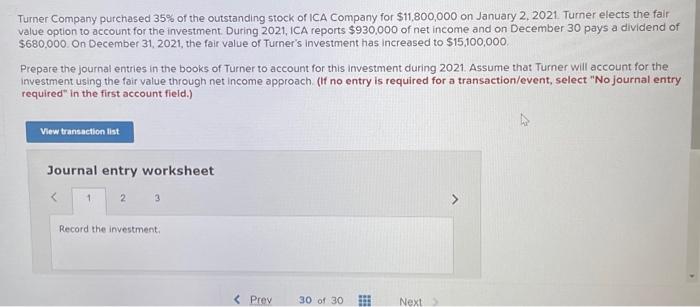

Turner Company purchased of the outstanding stock of ICA Company for on January 2,2021 Tumer elects the fair value option to account for the investment. During 2021, ICA reports of net income and on December 30 pays a dividend of . On December 31,2021 , the fair value of Turner's investment has increased to . Prepare the journal entries in the books of Turner to account for this investment during 2021. Assume that Turner will account for the investment using the fair value through net income approach. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.)

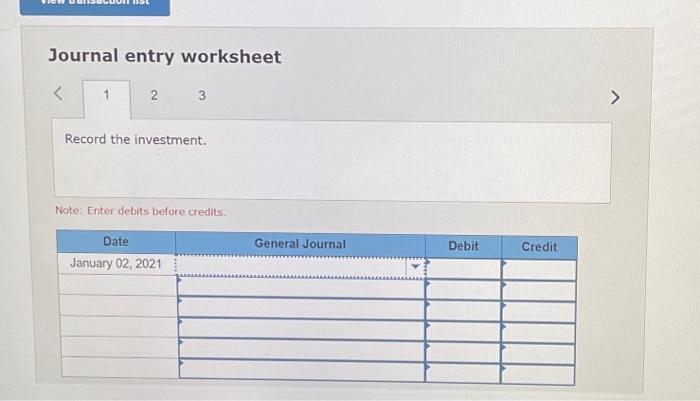

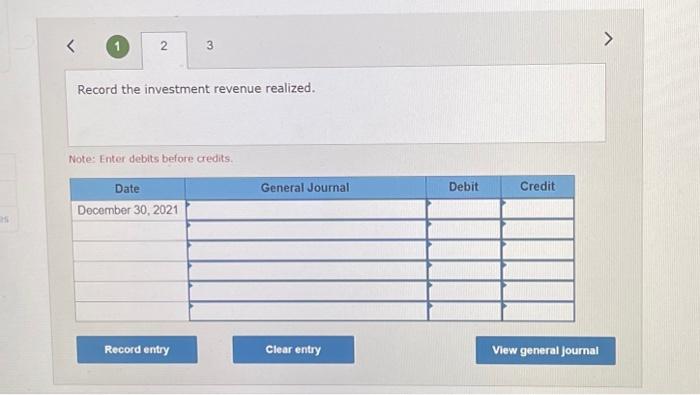

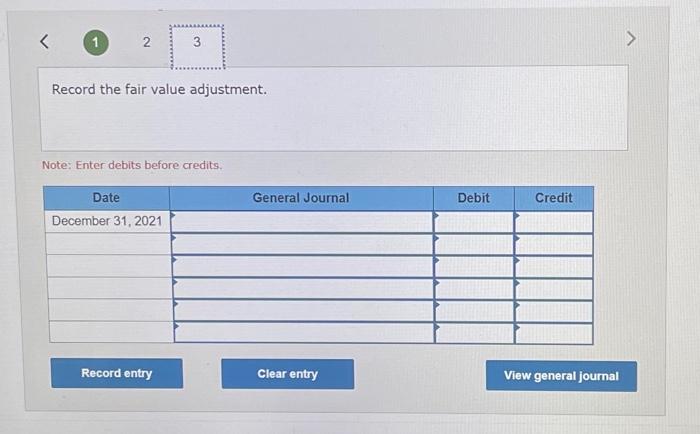

Journal entry worksheet

Record the investment revenue realized. Note: Enter debits before credits.

Record the fair value adjustment. Note: Enter debits before credits.

Expert Answer

ANSWER : 1).JOURNAL ENTRIES : Record the investment -The value of investment purchased is $11,800,000 . So, the entry will be made by ICA company from full amount of $11,800,000.