(Solved): Unida Systems has 44 million shares outstanding trading for $12 per share. In addition, Unida has $8 ...

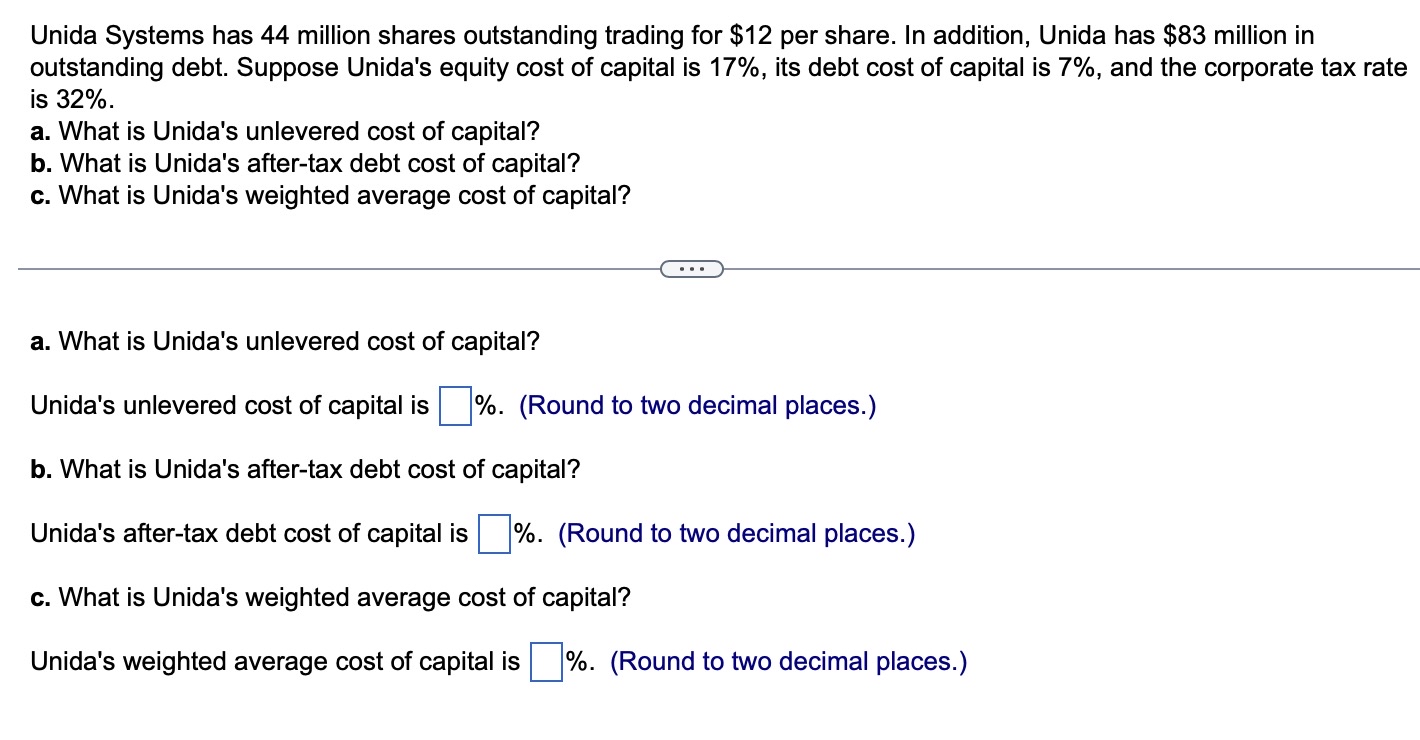

Unida Systems has 44 million shares outstanding trading for

$12per share. In addition, Unida has

$83million in outstanding debt. Suppose Unida's equity cost of capital is

17%, its debt cost of capital is

7%, and the corporate tax rate is

32%. a. What is Unida's unlevered cost of capital? b. What is Unida's after-tax debt cost of capital? c. What is Unida's weighted average cost of capital? a. What is Unida's unlevered cost of capital? Unida's unlevered cost of capital is

%. (Round to two decimal places.) b. What is Unida's after-tax debt cost of capital? Unida's after-tax debt cost of capital is %. (Round to two decimal places.) c. What is Unida's weighted average cost of capital? Unida's weighted average cost of capital is %. (Round to two decimal places.)