(Solved): Use below information for Questions 5 to 7: Company X uses a job cost system and applies overhead to ...

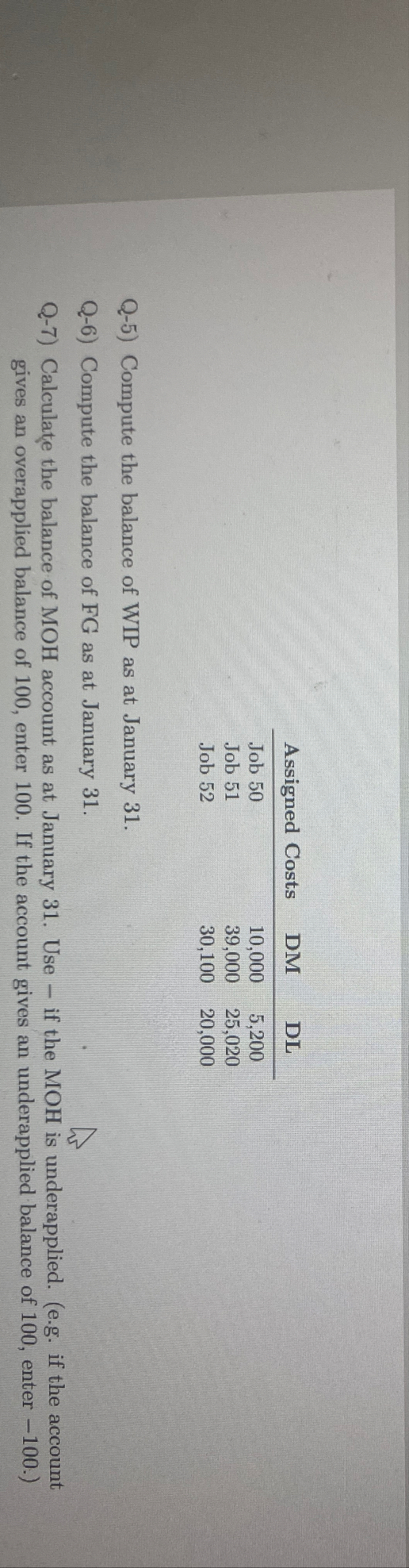

Use below information for Questions 5 to 7: Company X uses a job cost system and applies overhead to production on the basis of direct labor cost. On January 1, 2018 , Job 50 was the only job in process. The costs incurred prior to January 1 on this job were as follows: DM of TL22,000, DL of TL11,600, and MOH of TL15,001. As of January 1, Job 49 had been completed at a cost of TL85,002 and was part of finished goods inventory. There was a TL13,500 balance in the raw materials inventory account. During the month of January, Company X began production on Jobs 51 and 52, and completed Jobs 50 and 51. Jobs 49 and 50 were sold on account during the month for TL122,600 and TL158,020, respectively. Following additional events occurred during the month: Purchased additional raw materials of TL95,002 on account. Incurred factory labor costs of TL64,600 exclusive of payroll taxes. Payroll taxes amounted to TL16,010. Incurred indirect materials of TL17,000, and indirect labor of TL20,001 Depreciation on factory equipment totalled to TL12,000 Other factory expenses on account were TL12,000 During the month, Company X assigned following costs to respective jobs as follows: Company X estimates total manufacturing overhead costs of TL882,000, direct labor costs of TL700,010 and direct labor hours 20,060 for the year. 2\table[[Assigned Costs,DM,DL],[Job 50,10,000,5,200],[Job 51,39,000,25,020],[Job 52,30,100,20,000]] Q-5) Compute the balance of WIP as at January 31. Q-6) Compute the balance of FG as at January 31. Q-7) Calculate the balance of MOH account as at January 31. Use - if the MOH is underapplied. (e.g. if the account gives an overapplied balance of 100 , enter 100 . If the account gives an underapplied balance of 100 , enter -100 .)