Home /

Expert Answers /

Accounting /

use-the-following-end-of-period-spreadsheet-to-answer-the-question-that-follow-finley-company-end-pa496

(Solved): Use the following end-of-period spreadsheet to answer the question that follow. Finley Company End- ...

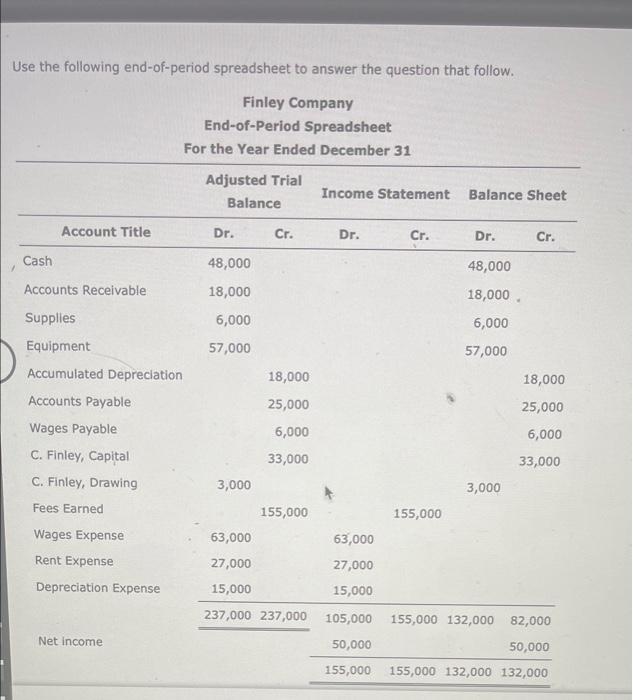

Use the following end-of-period spreadsheet to answer the question that follow. Finley Company End-of-Period Spreadsheet For the Year Ended December 31 Adjusted Trial Balance Account Title Cash Accounts Receivable Supplies Equipment Accumulated Depreciation Accounts Payable Wages Payable C. Finley, Capital C. Finley, Drawing Fees Earned Wages Expense Rent Expense Depreciation Expense Net income Dr. 48,000 18,000 6,000 57,000 3,000 Cr. 18,000 25,000 6,000 33,000 155,000 63,000 27,000 15,000 237,000 237,000 Income Statement Dr. 63,000 27,000 15,000 Cr. 155,000 Balance Sheet Dr. 48,000 18,000 6,000 57,000 3,000 Cr. 18,000 25,000 6,000 33,000 105,000 155,000 132,000 82,000 50,000 50,000 155,000 155,000 132,000 132,000

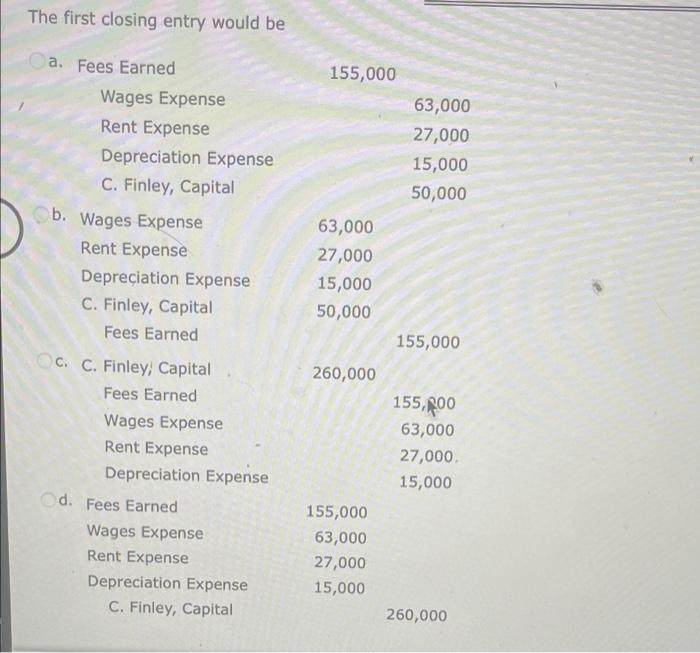

The first closing entry would be a. Fees Earned Wages Expense Rent Expense Depreciation Expense C. Finley, Capital Ob. Wages Expense Rent Expense Depreciation Expense C. Finley, Capital Fees Earned OC. C. Finley, Capital Fees Earned Wages Expense Rent Expense Depreciation Expense Od. Fees Earned Wages Expense Rent Expense Depreciation Expense C. Finley, Capital 155,000 63,000 27,000 15,000 50,000 260,000 155,000 63,000 27,000 15,000 63,000 27,000 15,000 50,000 155,000 155,00 63,000 27,000. 15,000 260,000