(Solved): Use the present value tables in Appendix A and Appendix B to compute the NPV of each of the followin ...

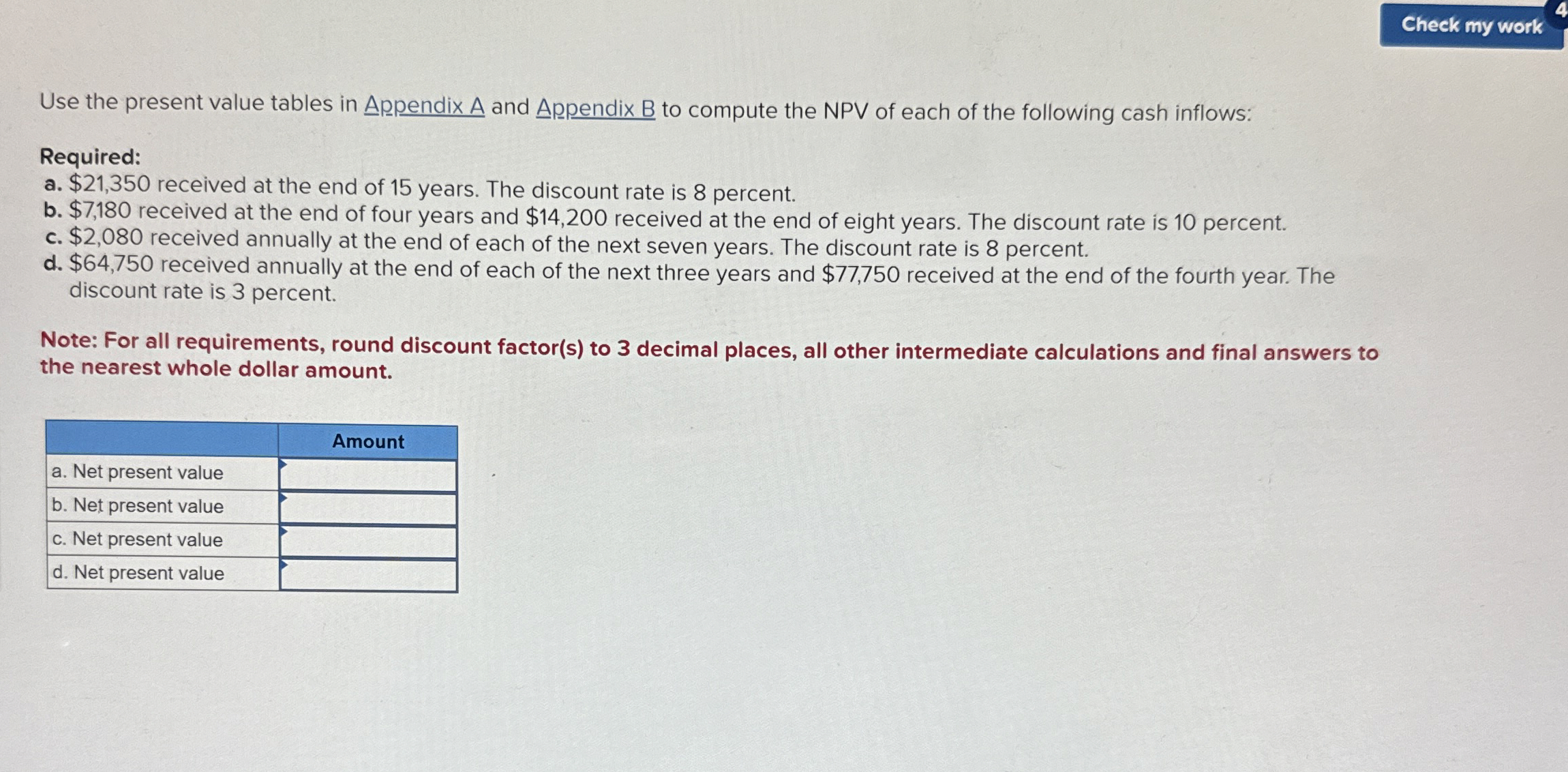

Use the present value tables in Appendix A and Appendix B to compute the NPV of each of the following cash inflows: Required: a.

$21,350received at the end of 15 years. The discount rate is 8 percent. b.

$7,180received at the end of four years and

$14,200received at the end of eight years. The discount rate is 10 percent. c.

$2,080received annually at the end of each of the next seven years. The discount rate is 8 percent. d.

$64,750received annually at the end of each of the next three years and

$77,750received at the end of the fourth year. The discount rate is 3 percent. Note: For all requirements, round discount factor(s) to 3 decimal places, all other intermediate calculations and final answers to the nearest whole dollar amount. \table[[,Amount],[a. Net present value,],[b. Net present value,],[c. Net present value,],[d. Net present value,]]