Home /

Expert Answers /

Economics /

v-assume-flexible-exchange-rates-keynesian-perfect-capital-markets-small-country-1-trace-thro-pa795

(Solved): V. Assume: Flexible Exchange Rates Keynesian Perfect Capital Markets Small Country > 1) Trace thro ...

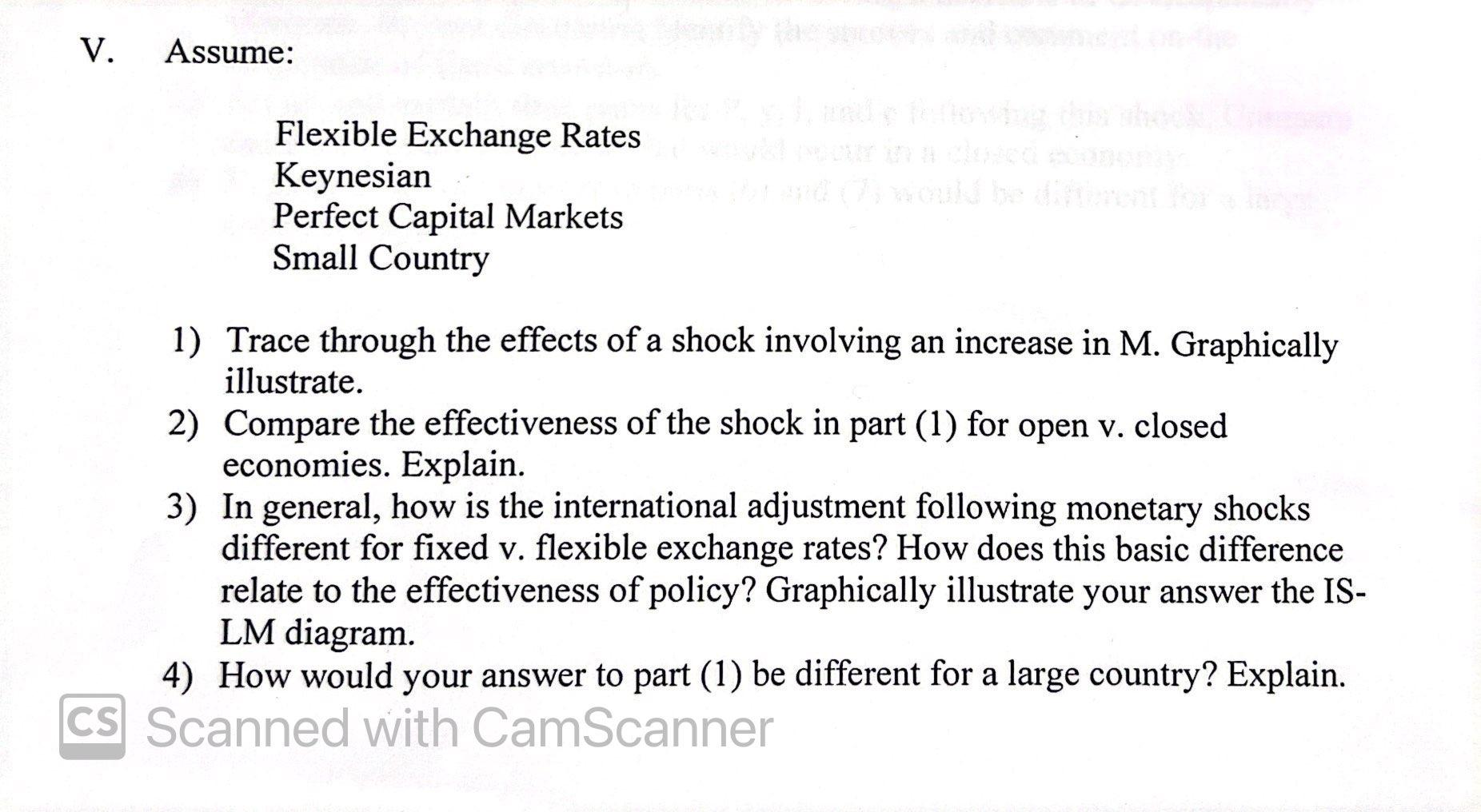

V. Assume: Flexible Exchange Rates Keynesian Perfect Capital Markets Small Country > 1) Trace through the effects of a shock involving an increase in M. Graphically illustrate. 2) Compare the effectiveness of the shock in part (1) for open v. closed economies. Explain. 3) In general, how is the international adjustment following monetary shocks different for fixed v. flexible exchange rates? How does this basic difference relate to the effectiveness of policy? Graphically illustrate your answer the IS- LM diagram. 4) How would your answer to part (1) be different for a large country? Explain. CS Scanned with CamScanner

Expert Answer

Introduction: The economic level of a country y is low than the country changes a flexible exchange rate system. Explanation: It will effect the capital flows in to the country and the interest rates are elastic. This will be explained through The Ma