Home /

Expert Answers /

Finance /

vega-plc-has-been-listed-on-the-london-stock-exchange-since-2008-the-company-has-the-beta-of-1-4-pa854

(Solved): . vega Plc has been listed on the London Stock Exchange since 2008. The company has the beta of 1.4 ...

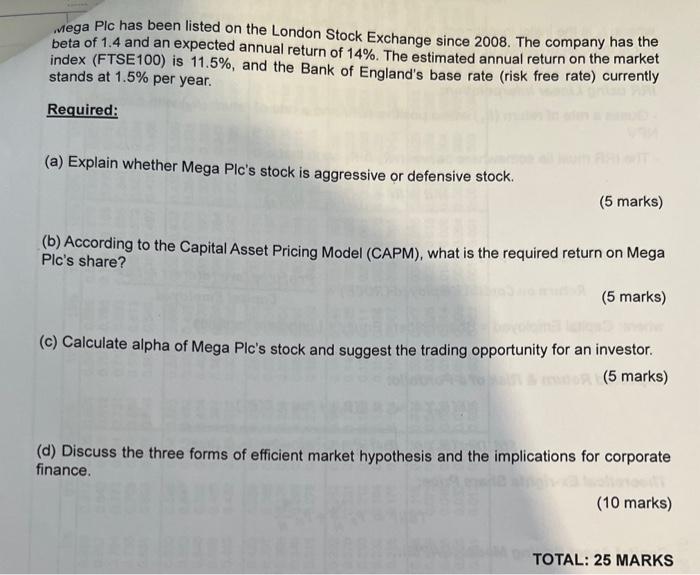

. vega Plc has been listed on the London Stock Exchange since 2008. The company has the beta of 1.4 and an expected annual return of . The estimated annual return on the market index (FTSE100) is 11.5\%, and the Bank of England's base rate (risk free rate) currently stands at per year. Required: (a) Explain whether Mega Plc's stock is aggressive or defensive stock. (5 marks) (b) According to the Capital Asset Pricing Model (CAPM), what is the required return on Mega Plc's share? (5 marks) (c) Calculate alpha of Mega Plc's stock and suggest the trading opportunity for an investor. (5 marks) (d) Discuss the three forms of efficient market hypothesis and the implications for corporate finance. (10 marks)

Expert Answer

(a) Based on the beta value of 1.4, Vega Plc's stock is considered an aggressive stock. This means that its returns are expected to be more volatile than the market returns. (b) The required return on Vega Plc's share can be calculated using the Capital Asset Pricing Model (CAPM), which is: Required return = Risk-free rate + Beta x (Market return - Risk-free rate). Using the given values, the required return on Vega ...