Home /

Expert Answers /

Finance /

when-crane-corp-issued-its-60-day-commercial-paper-the-promised-yield-was-11-1-percent-whereas-th-pa912

(Solved): When Crane Corp. issued its 60-day commercial paper, the promised yield was 11.1 percent, whereas th ...

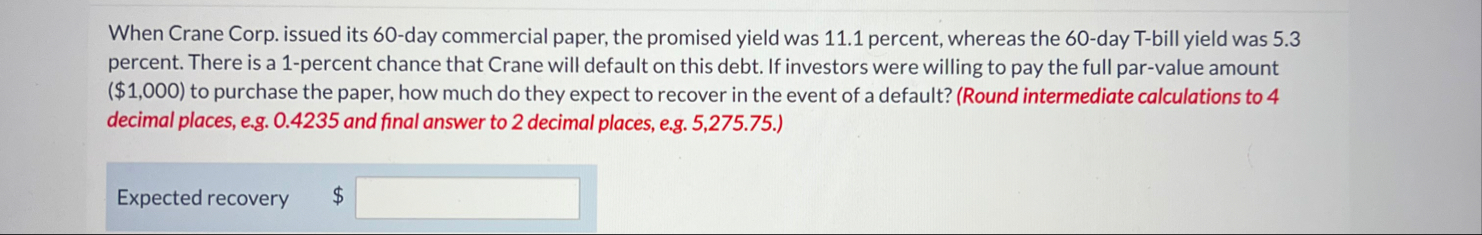

When Crane Corp. issued its 60-day commercial paper, the promised yield was 11.1 percent, whereas the 60-day T-bill yield was 5.3 percent. There is a 1-percent chance that Crane will default on this debt. If investors were willing to pay the full par-value amount

($1,000)to purchase the paper, how much do they expect to recover in the event of a default? (Round intermediate calculations to 4 decimal places, e.g. 0.4235 and final answer to 2 decimal places, e.g. 5,275.75.) Expected recovery $

◻