Home /

Expert Answers /

Finance /

which-of-the-following-bonds-would-be-likely-to-exhibit-a-greater-degree-of-interest-rate-risk-a-pa333

(Solved): Which of the following bonds would be likely to exhibit a greater degree of interest-rate risk? A ...

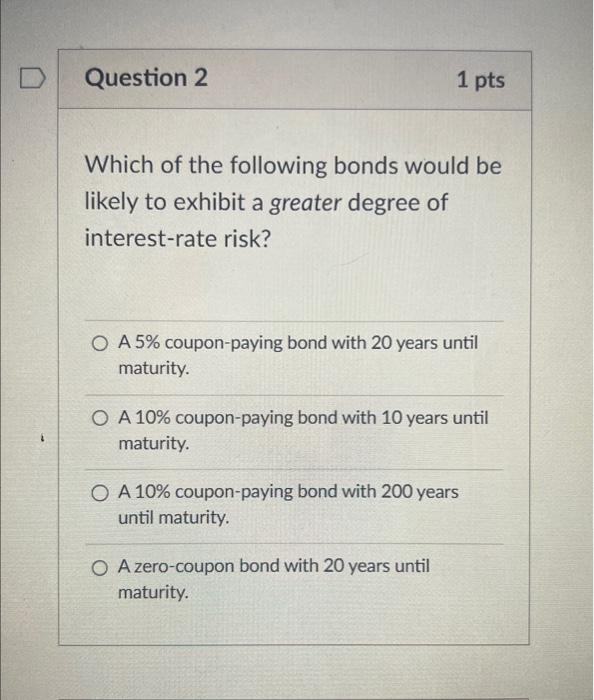

Which of the following bonds would be likely to exhibit a greater degree of interest-rate risk? A coupon-paying bond with 20 years until maturity. A coupon-paying bond with 10 years until maturity. A coupon-paying bond with 200 years until maturity. A zero-coupon bond with 20 years until maturity.

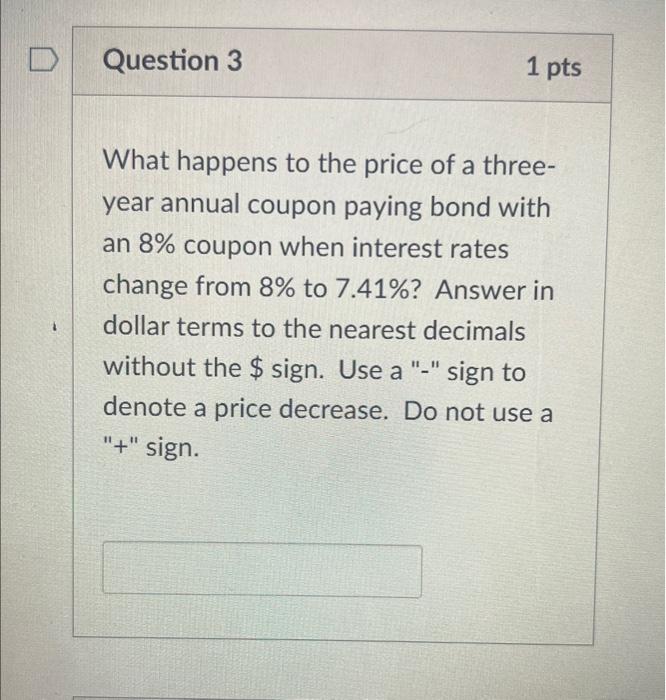

What happens to the price of a threeyear annual coupon paying bond with an coupon when interest rates change from to ? Answer in dollar terms to the nearest decimals without the \$ sign. Use a "-" sign to denote a price decrease. Do not use a "+" sign.

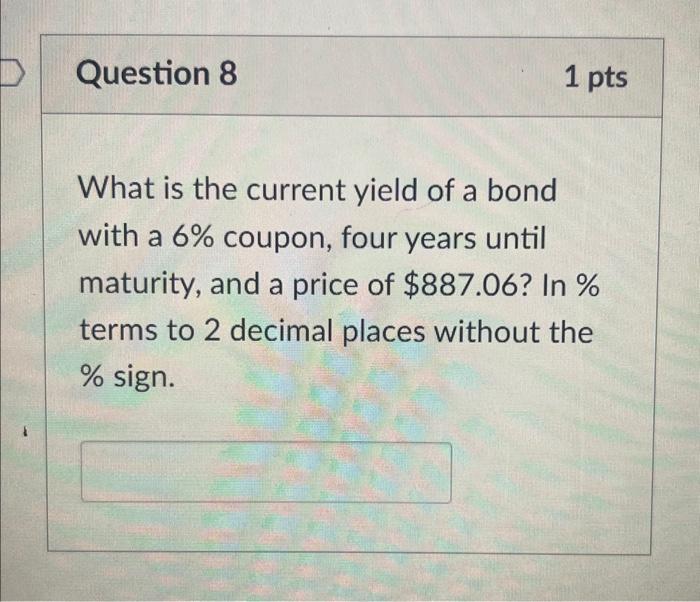

What is the current yield of a bond with a coupon, four years until maturity, and a price of ? In \% terms to 2 decimal places without the sign.