Home /

Expert Answers /

Finance /

which-of-the-following-statements-is-correct-in-relation-to-long-run-performance-of-ipos-o-the-inv-pa492

(Solved): Which of the following statements is correct in relation to long-run performance of IPOs? O The inv ...

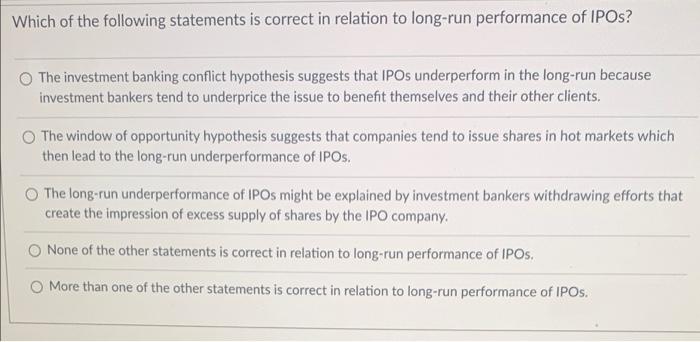

Which of the following statements is correct in relation to long-run performance of IPOs? O The investment banking conflict hypothesis suggests that IPOs underperform in the long-run because investment bankers tend to underprice the issue to benefit themselves and their other clients. The window of opportunity hypothesis suggests that companies tend to issue shares in hot markets which then lead to the long-run underperformance of IPOs. The long-run underperformance of IPOs might be explained by investment bankers withdrawing efforts that create the impression of excess supply of shares by the IPO company. None of the other statements is correct in relation to long-run performance of IPOS. More than one of the other statements is correct in relation to long-run performance of IPOS.

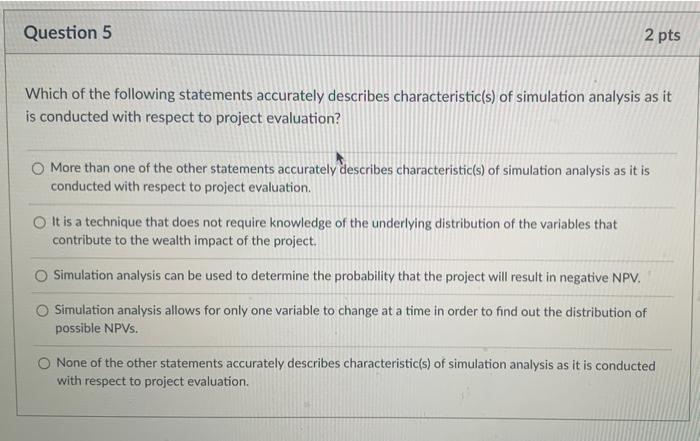

Question 5 2 pts Which of the following statements accurately describes characteristic(s) of simulation analysis as it is conducted with respect to project evaluation? More than one of the other statements accurately describes characteristic(s) of simulation analysis as it is conducted with respect to project evaluation. O It is a technique that does not require knowledge of the underlying distribution of the variables that contribute to the wealth impact of the project. Simulation analysis can be used to determine the probability that the project will result in negative NPV. Simulation analysis allows for only one variable to change at a time in order to find out the distribution of possible NPVs. None of the other statements accurately describes characteristic(s) of simulation analysis as it is conducted with respect to project evaluation.

Expert Answer

ANSWER 1. E) More than one of the other statements is correct in relation to long run underperformanc