Home /

Expert Answers /

Finance /

you-are-a-provider-of-portfolio-insurance-and-are-establishing-a-four-year-pr-pa154

(Solved): You are a provider of portfolio insurance and are establishing a four-year pr ...

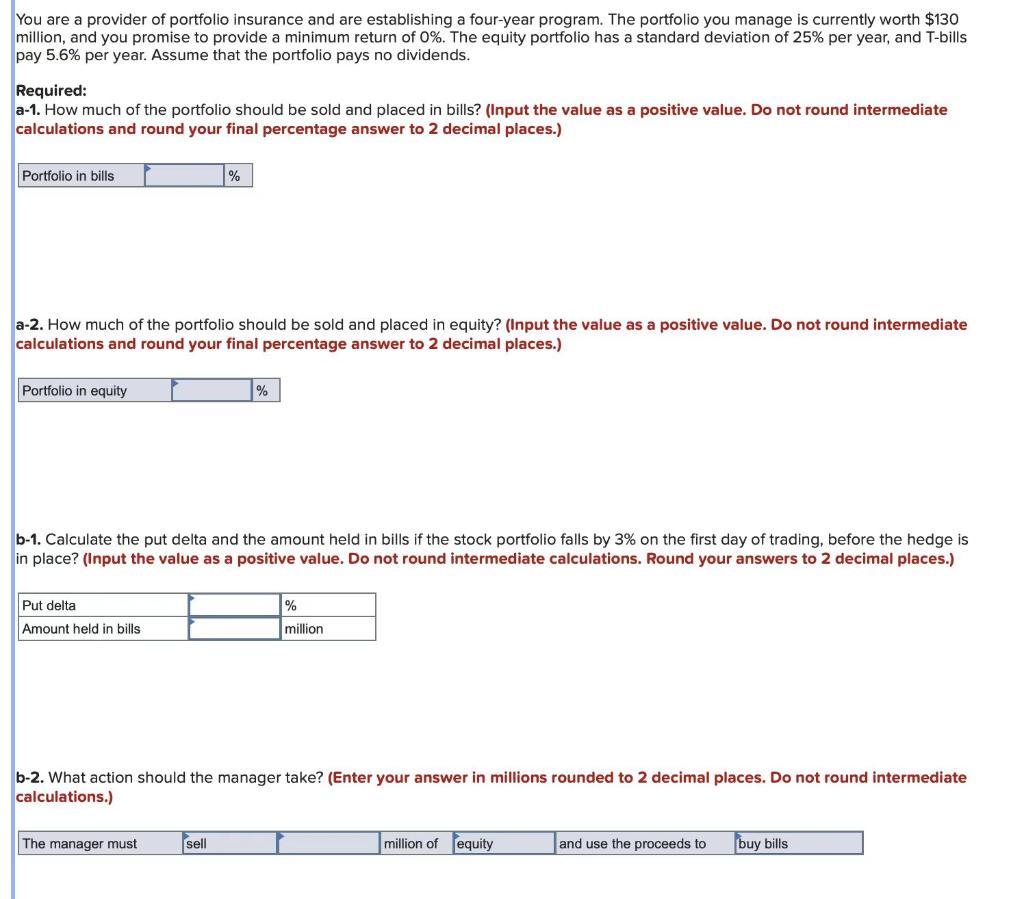

You are a provider of portfolio insurance and are establishing a four-year program. The portfolio you manage is currently worth million, and you promise to provide a minimum return of . The equity portfolio has a standard deviation of per year, and T-bills Day per year. Assume that the portfolio pays no dividends. Required: a-1. How much of the portfolio should be sold and placed in bills? (Input the value as a positive value. Do not round intermediate calculations and round your final percentage answer to 2 decimal places.) -2. How much of the portfolio should be sold and placed in equity? (Input the value as a positive value. Do not round intermediate calculations and round your final percentage answer to 2 decimal places.) o-1. Calculate the put delta and the amount held in bills if the stock portfolio falls by on the first day of trading, before the hedge is n place? (Input the value as a positive value. Do not round intermediate calculations. Round your answers to 2 decimal places.) o-2. What action should the manager take? (Enter your answer in millions rounded to 2 decimal places. Do not round intermediate calculations.)

Expert Answer

Solution:a-1) Calculation of the Percentage of the Portfolio should be Placed in Bills: (current value of the portfolio) (floor promised to clients, 0% return) (volatility)