Home /

Expert Answers /

Finance /

you-are-planning-to-buy-a-lottery-ticket-for-the-226-000-000-jackpot-if-you-have-option-a-the-c-pa356

(Solved): You are planning to buy a lottery ticket for the $226,000,000 jackpot. If you have (Option A). the c ...

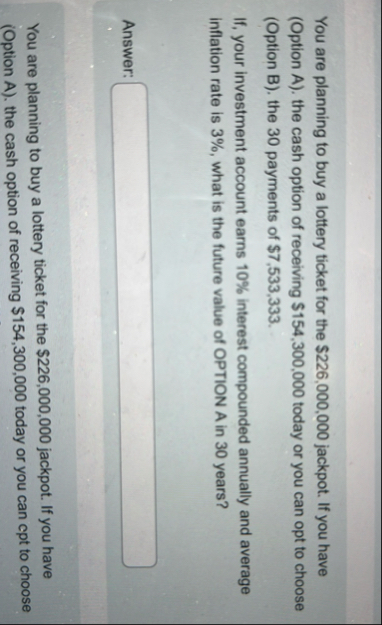

You are planning to buy a lottery ticket for the

$226,000,000jackpot. If you have (Option A). the cash option of receiving

$154,300,000today or you can opt to choose (Option B). the 30 payments of

$7,533,333. If, your investment account earns

10%interest compounded annually and average inflation rate is

3%, what is the future value of OPTION A in 30 years?

◻You are planning to buy a lottery ticket for the

$226,000,000jackpot. If you have (Option A). the cash option of receiving

$154,300,000today or you can cpt to choose