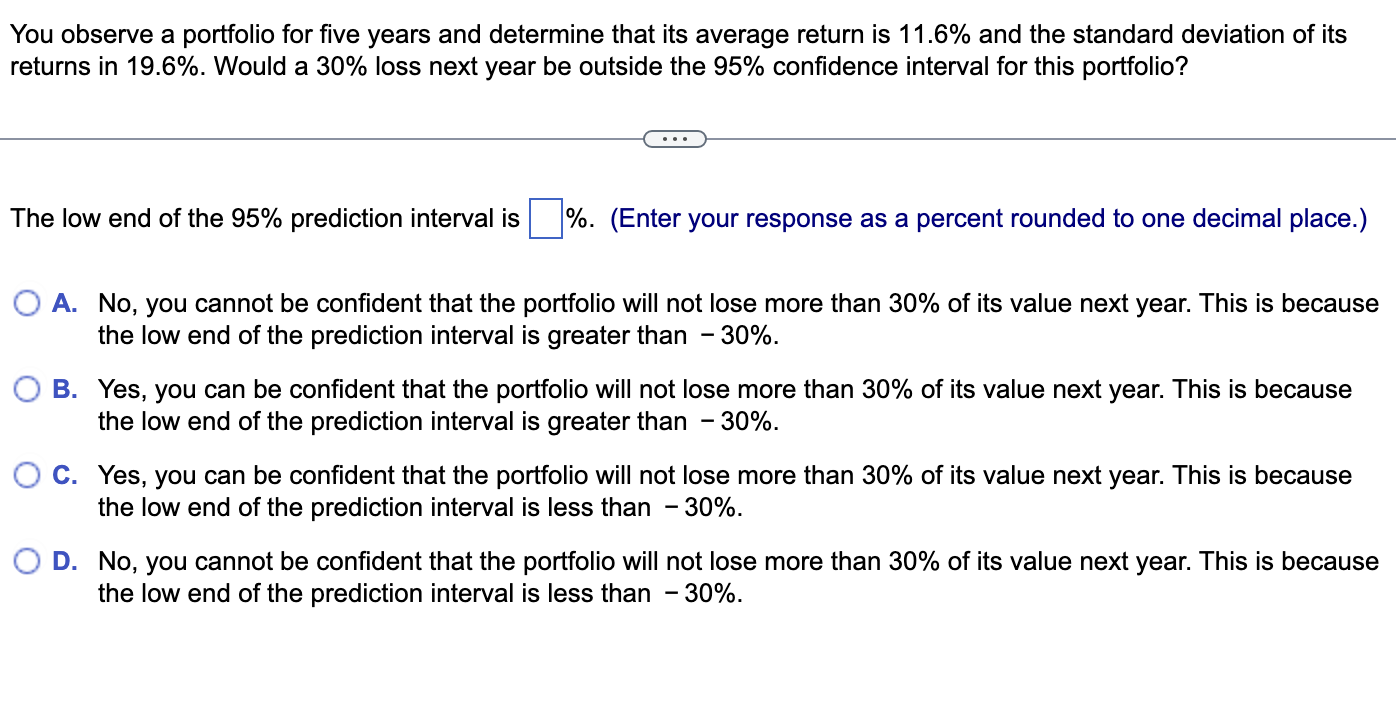

(Solved): You observe a portfolio for five years and determine that its average return is 11.6% and the stan ...

You observe a portfolio for five years and determine that its average return is

11.6%and the standard deviation of its returns in

19.6%. Would a

30%loss next year be outside the

95%confidence interval for this portfolio? The low end of the

95%prediction interval is %. (Enter your response as a percent rounded to one decimal place.) A. No, you cannot be confident that the portfolio will not lose more than

30%of its value next year. This is because the low end of the prediction interval is greater than

-30%. B. Yes, you can be confident that the portfolio will not lose more than

30%of its value next year. This is because the low end of the prediction interval is greater than

-30%. C. Yes, you can be confident that the portfolio will not lose more than

30%of its value next year. This is because the low end of the prediction interval is less than

-30%. D. No, you cannot be confident that the portfolio will not lose more than

30%of its value next year. This is because the low end of the prediction interval is less than

-30%.You observe a portfolio for five years and determine that its average return is 11.6% and the standard deviation of its returns in 19.6%. Would a 30% loss next year be outside the 95% confidence interval for this portfolio?