Home /

Expert Answers /

Finance /

your-current-portfolio-consists-of-three-assets-the-common-stock-of-ibm-and-gm-combined-with-stmen-pa465

(Solved): Your current portfolio consists of three assets, the common stock of IBM and GM combined with stmen ...

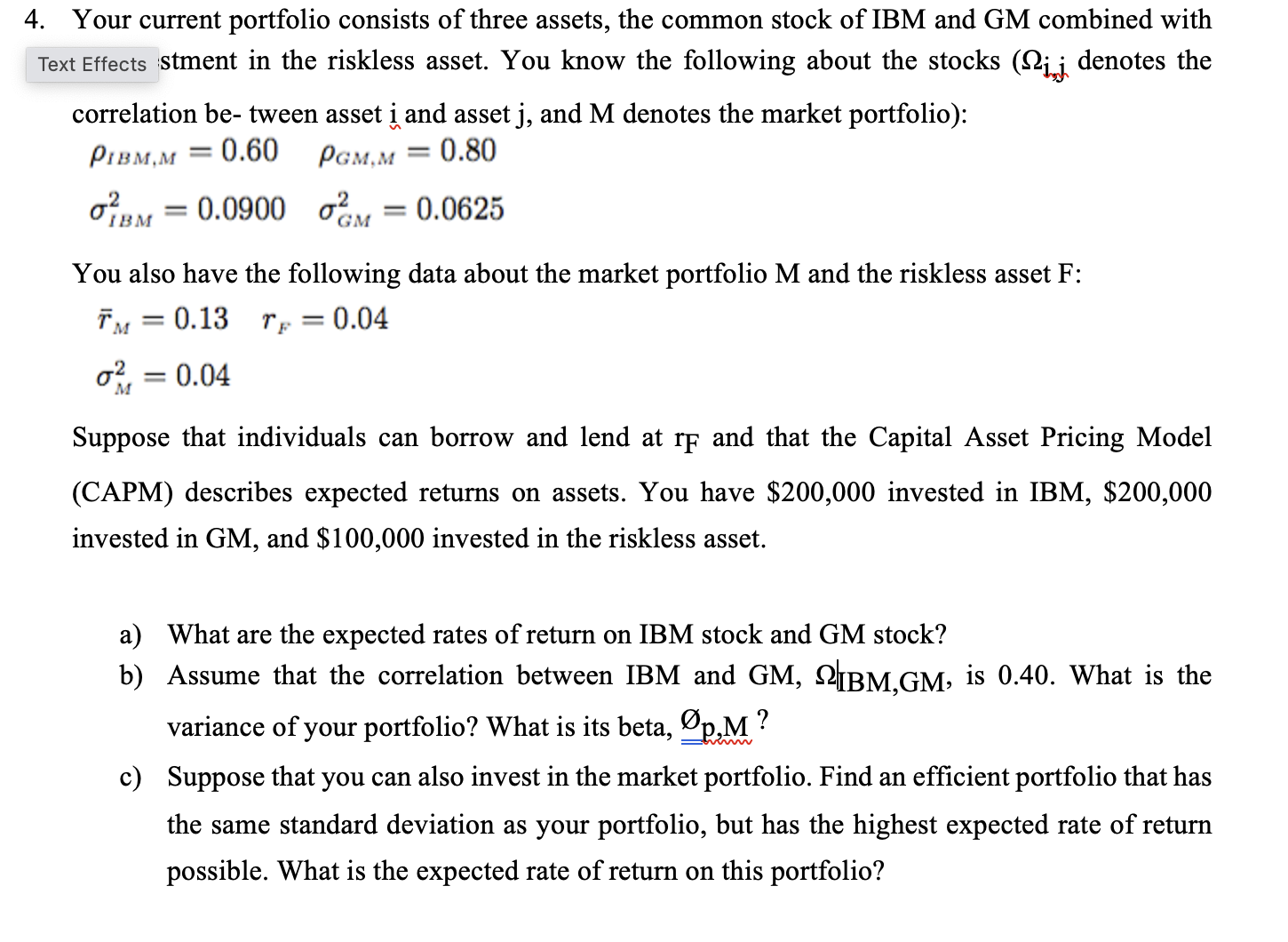

Your current portfolio consists of three assets, the common stock of IBM and GM combined with stment in the riskless asset. You know the following about the stocks denotes the correlation be- tween asset and asset , and denotes the market portfolio): You also have the following data about the market portfolio and the riskless asset : Suppose that individuals can borrow and lend at and that the Capital Asset Pricing Model (CAPM) describes expected returns on assets. You have invested in IBM, \$200,000 invested in GM, and invested in the riskless asset. a) What are the expected rates of return on IBM stock and GM stock? b) Assume that the correlation between IBM and GM, , is 0.40 . What is the variance of your portfolio? What is its beta, ? c) Suppose that you can also invest in the market portfolio. Find an efficient portfolio that has the same standard deviation as your portfolio, but has the highest expected rate of return possible. What is the expected rate of return on this portfolio?